Now Reading: Understanding the Luhn Algorithm: How It Secures Credit Card Numbers

-

01

Understanding the Luhn Algorithm: How It Secures Credit Card Numbers

Understanding the Luhn Algorithm: How It Secures Credit Card Numbers

### Quick Summary

– The Luhn algorithm, developed in 1960 by IBM researcher Hans Peter Luhn, ensures the validity of credit card numbers and corrects common input errors.

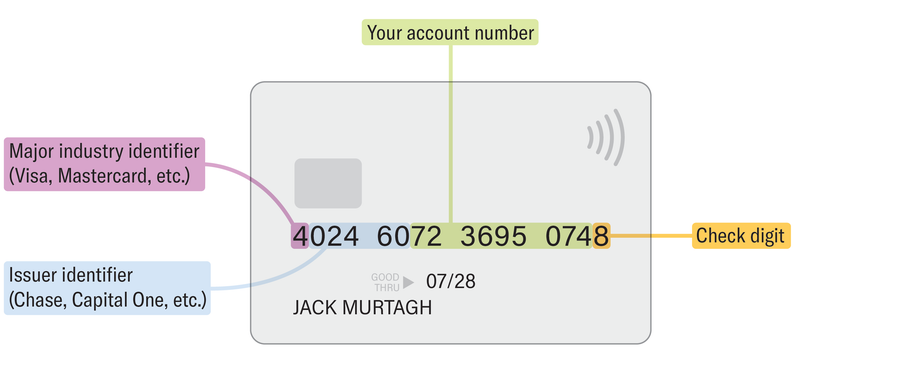

– Credit card numbers consist of structured parts: industry identifier (first digit), bank or institution code (next five to seven digits), account number, and a “check digit” steadfast by the algorithm.

– Steps in the Luhn algorithm:

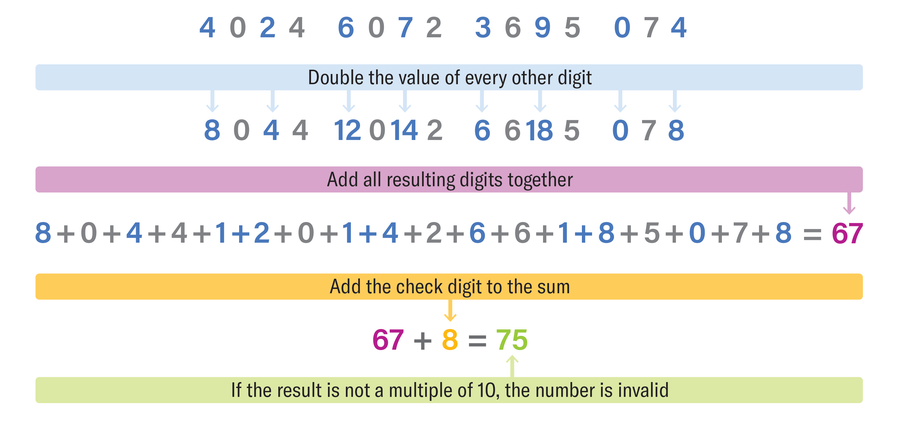

1. Write out all but the last digit.

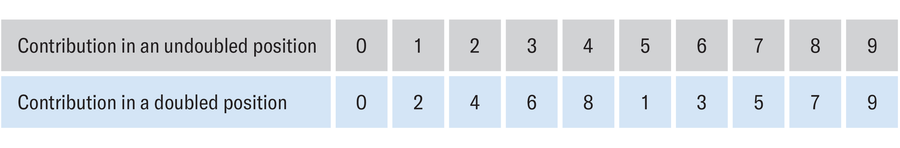

2. Double every other number starting from the right.

3. Sum all resulting digits (e.g., doubling “7” gives “14,” which adds up to “1 + 4 = 5”).

4. Add check digit-if the total isn’t a multiple of ten, it’s invalid.

– The algorithm detects common errors such as mistyping a single digit or swapping adjacent digits except for specific cases like “09” swapped with “90.”

– Though Verhoeff’s more refined validation method exists, Luhn’s simplicity has made it ubiquitous in error detection for credit cards worldwide.

—

### Indian Opinion analysis

The widespread implementation of algorithms like Luhn highlights how mathematical ingenuity can serve everyday financial systems at minimal computational cost while safeguarding transactions against human error and potential fraud attempts. For India-a rapidly modernizing economy experiencing growth in online payments-the adoption of efficient error-checking methods such as this is paramount for promoting smooth digital interactions.

While security infrastructure like multi-factor authentication advances globally, India’s burgeoning e-commerce sector stands to benefit significantly from basic yet effective mechanisms that reduce needless burden on validation services-saving both operational time and costs for businesses handling millions of transactions daily.

Additionally, educating Indian consumers about these behind-the-scenes technologies could foster greater confidence in adopting digital payment methods while ensuring that systemic safeguards remain robust enough to protect users amidst rising cybercrime risks.

[Read More](https://www.scientificamerican.com/article/what-is-the-luhn-algorithm-the-math-behind-secure-credit-card-numbers/)