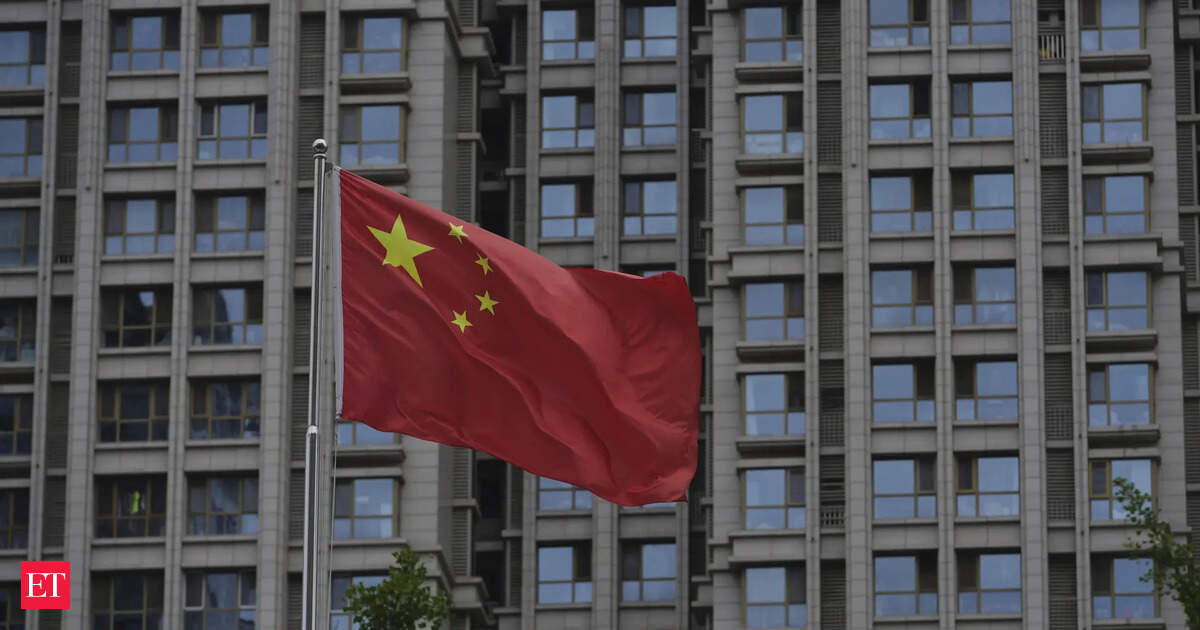

Now Reading: China Pharma Firms Tap Local Reagents to Slash Costs, Speed Deliveries

-

01

China Pharma Firms Tap Local Reagents to Slash Costs, Speed Deliveries

China Pharma Firms Tap Local Reagents to Slash Costs, Speed Deliveries

Quick Summary

- Pharmaceutical firms in China are increasingly sourcing reagents locally to cut costs and delivery times.

- U.S. company Thermo Fisher Scientific and Germany’s Merck previously dominated China’s reagent import market, valued at $5.76 billion in 2024.

- Raising U.S. tariffs to 125% in April spurred Chinese firms to shift toward domestic suppliers like Shanghai Titan Scientific and Nanjing Vazyme Biotech.

- Local companies report increased demand for their products-over 90% of Vazyme’s customers have explored switching from imported reagents recently.

- Sales for domestic suppliers like Titan (22% growth forecast) and vazyme (15% forecast) continue to rise, contrasting with falling stock prices of Western competitors Merck (-21%) and Thermo Fisher (-8%) this year.

- Challenges exist in switching reagents due to regulatory approval processes and technological barriers.

Indian Opinion Analysis

China’s shift toward localized reagent procurement signifies broader implications for global pharmaceutical supply chains, especially amid geopolitical trade uncertainties such as tariff hikes. Such trends highlight teh strategic importance of reducing reliance on imports, which could inspire similar moves by countries seeking self-sufficiency in critical industries like healthcare innovation.

For India-a growing hub for pharmaceuticals-the potential chance lies in leveraging its manufacturing capabilities as an choice supplier amid international tensions. Though, India’s ability to capitalize may depend on overcoming technological hurdles similar to those noted in China’s switch from Western suppliers. Ultimately, China’s pivot emphasizes the long-term importance of fostering robust domestic ecosystems that ensure cost efficiency without compromising regulatory standards.