Now Reading: India Bonds Gain Amid Powell’s Dovish Tone, Fiscal Worries Linger

1

-

01

India Bonds Gain Amid Powell’s Dovish Tone, Fiscal Worries Linger

India Bonds Gain Amid Powell’s Dovish Tone, Fiscal Worries Linger

Quick Summary

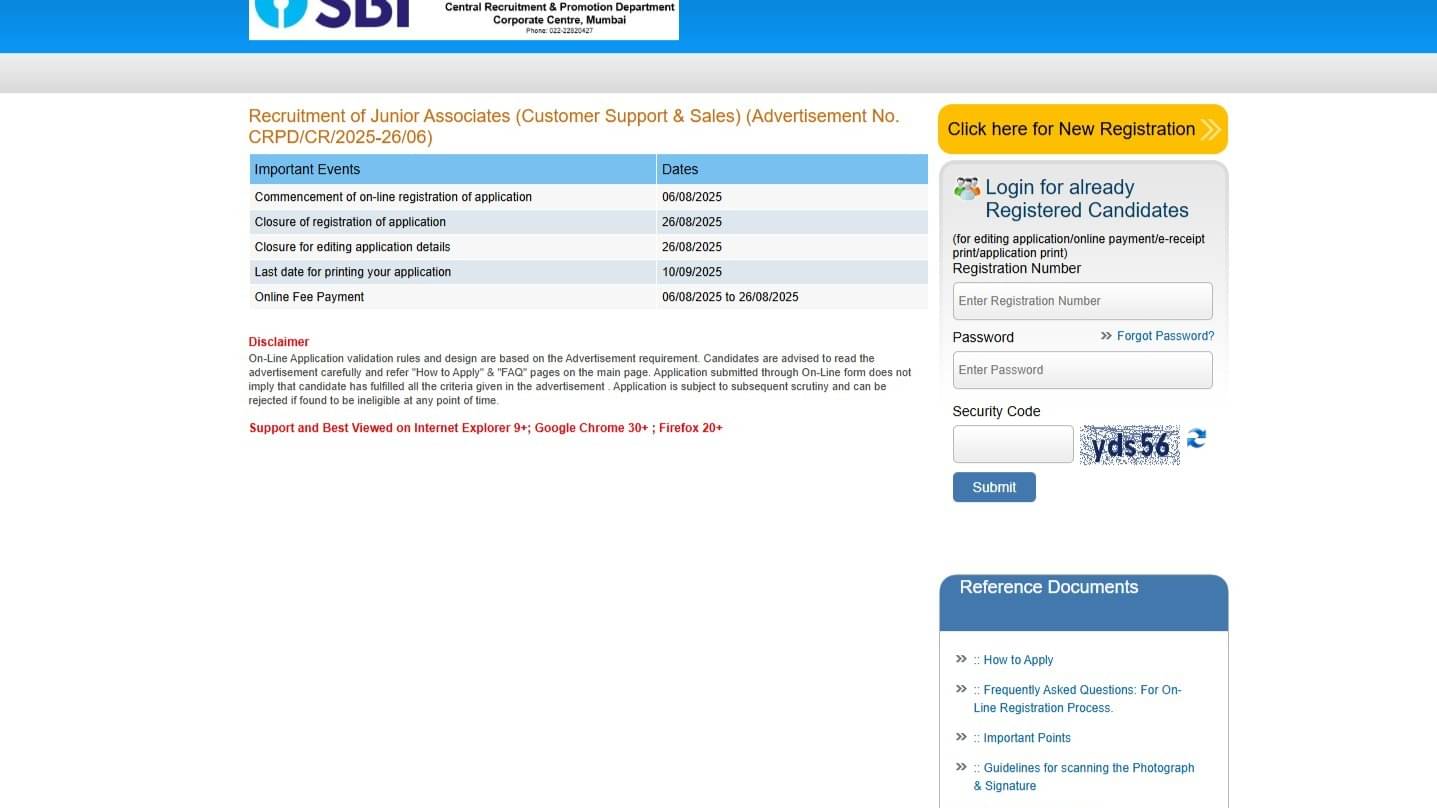

- Indian goverment bonds rebounded on Monday following last week’s sharp decline, driven by improved sentiment after U.S. Fed Chair Jerome Powell hinted at a possible interest rate cut in September due to rising risks to the job market.

- India’s 10-year benchmark bond yield decreased slightly to 6.54%, compared to Friday’s close of 6.55%, reversing some of last week’s steep rise (15 basis points), which was the largest uptick in over three years.

- Bond yields inversely move with prices; trader remarks suggest fiscal slippage fears are still present, limiting bullish activity.

- Powell emphasized inflation remains a concern and any rate cut decision is not definitive; CME FedWatch Tool indicated an almost 90% probability of a 25-basis-point cut by September.

- Concerns about fiscal slippage have also been amplified by discussions around India’s GST restructuring toward two rates (5% and 18%), scrapping existing slabs like 12% and 28%.

- A state ministers’ panel has endorsed this two-rate GST structure, perhaps requiring additional government borrowing if implemented.

- The GST Council plans to meet on September 3-4 for further deliberations on these changes.

- India’s overnight index swap (OIS) rates followed declining Treasury yields in low trading volumes: the one-year OIS rate remained untraded but was previously at 5.5250%; two-and five-year OIS fell slightly.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

Loading Next Post...