Now Reading: CM Backs Revamped GST Rates, Urges Fair Impact for Common Man

-

01

CM Backs Revamped GST Rates, Urges Fair Impact for Common Man

CM Backs Revamped GST Rates, Urges Fair Impact for Common Man

Swift Summary:

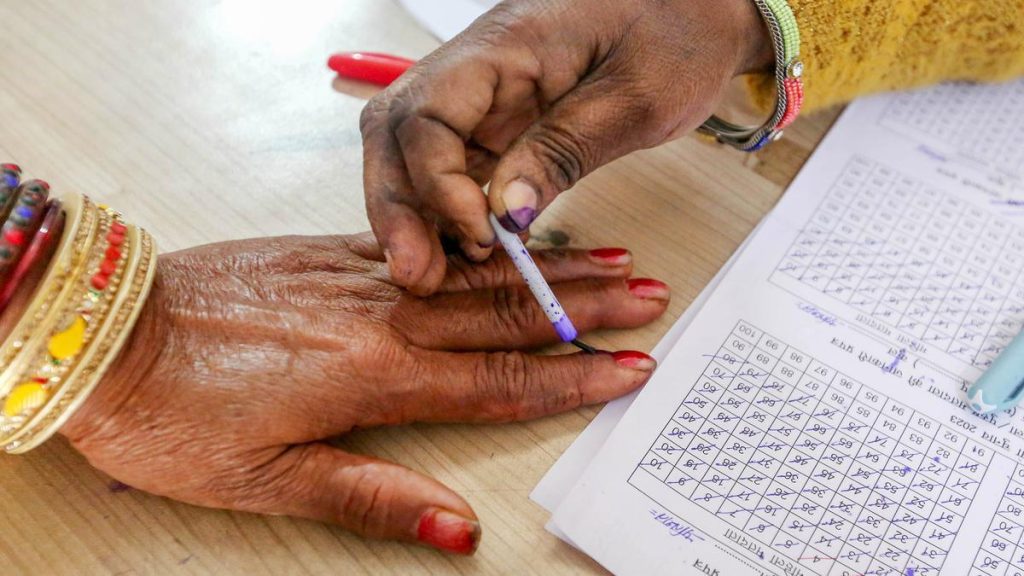

- karnataka Chief Minister Siddaramaiah welcomed the Center’s decision to rationalise GST rates but emphasized that the benefits must reduce prices for the public and not merely enhance corporate profits.

- He credited Congress leader Rahul Gandhi and opposition-led states for advocating similar reforms since 2016-17 and criticized the Modi government’s initial GST rollout as “faulty.”

- Siddaramaiah highlighted inequities in the current GST Council structure,where one-third of voting power lies with the Centre,while all states share two-thirds collectively. He argued this structure allows the Central government to block reforms even if all states agree.

- The CM claimed today’s decisions validate earlier criticisms, suggesting years of hardship could have been avoided had reforms been implemented sooner.

- Raising fiscal concerns for karnataka, Siddaramaiah stated that his state could lose ₹15,000-20,000 crore annually due to these changes and requested that GST compensation cess collected from “sin goods” be returned to states.

Indian Opinion Analysis:

The Chief Minister’s acknowledgment of GST rate rationalisation as a relief for monetary burdens reflects an crucial move toward simplified taxation in India. Though,his caution about ensuring benefits reach common citizens highlights a critical challenge-the potential disconnect between tax policy changes and actual consumer impact.

Siddaramaiah’s critique of central dominance within the GST council raises broader questions about federalism in India’s taxation framework. Despite legally structured checks and balances allowing state participation in decisions like GST reforms, unequal voting powers can create bottlenecks for timely resolutions.

his concerns over fiscal shortfalls underline a recurring issue faced by manny states following policy shifts-revenue sustainability without adequate compensation from central funds. This is particularly relevant given states’ reliance on their share of taxes to meet local progress goals. Ensuring equitable financial adjustments will be key to maintaining trust between state governments and New Delhi under such sweeping tax reforms.