Now Reading: Google’s Unstoppable Revenue Machine

-

01

Google’s Unstoppable Revenue Machine

Google’s Unstoppable Revenue Machine

Quick Summary

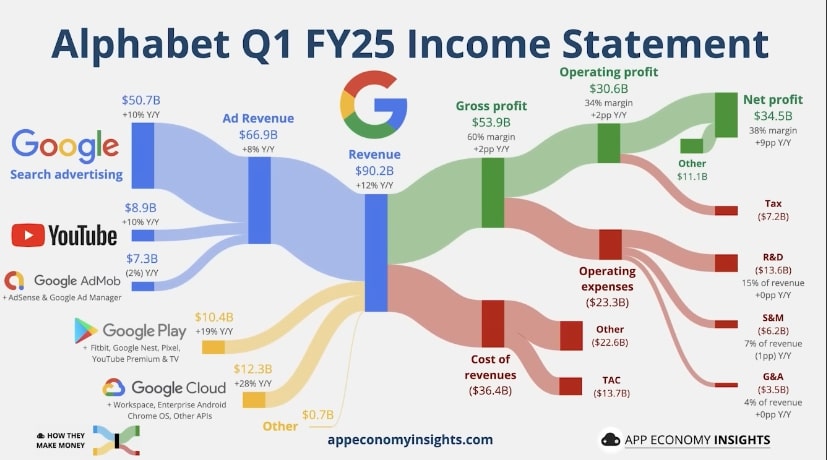

- Alphabet (Google) reported revenue of $90.23 billion and earnings per share (EPS) of $2.81, exceeding expectations for both categories.

– Expected revenue: $89.12 billion; reported: $90.23 billion.- Expected EPS: $2.01; reported: $2.81.

- Revenue breakdown:

– YouTube advertising revenue: $8.93 billion (slightly below expected).

– Google Cloud revenue: $12.26 billion (slightly below expected).

– Traffic acquisition costs (TAC): $13.75 billion, slightly higher than expected ($13.66 billion).

- Advertising overall contributed to significant growth:

– Total advertising revenue was up by 8.5%, reaching $66.89 billion.

- Google’s Search and Other segment earned $50.7 billion, reflecting a notable year-over-year growth of nearly 9.8%.

- AI advancements:

– Google’s AI tool “AI Overviews,” integrated into search results, now has over 1.5 billion monthly users-an increase from one billion users in October.

– Commentators like Chamath suggested prioritizing integration between Google products and the Gemini AI model for better optimization.

Images from the article:

!Ad Revenue Screenshot

Indian Opinion Analysis

Alphabet’s robust financial performance highlights the steady dominance of its core business models despite minor deviations in specific sectors like YouTube advertising and Google Cloud revenues missing projected targets by narrow margins.

India-specific implications stem primarily from the increasing incorporation of AI tools within search functionalities-a relevant point given India’s burgeoning internet user base driven heavily by mobile searches and an expanding digital literacy landscape supported by government policies such as Digital india initiatives.

Moreover, as Alphabet accelerates its focus on integrating technologies like Gemini into structured product ecosystems, it could provide opportunities for Indian businesses that rely on Google services to leverage advanced tools in advertising strategy or productivity optimization-potentially impacting e-commerce players or small enterprises that depend on such platforms.

India’s significant pool of tech talent also presents collaborative potentials if companies explore research partnerships on emerging fields like LLM-based models similar too GeminiAI itself .