Now Reading: Oil and Inflation Pose No Immediate Threats

-

01

Oil and Inflation Pose No Immediate Threats

Oil and Inflation Pose No Immediate Threats

Swift Summary

- Government in New Delhi is closely monitoring the situation in the Strait of Hormuz following a US attack on Iran and potential disruption threats from Iran.

- The Strait of Hormuz handles nearly 20% of global oil supply and serves as an export route for Persian Gulf nations such as Saudi Arabia, UAE, and iraq.

- Indian oil imports are diversified; this month, India imported more crude from Russia than combined shipments from West Asia.

- Brent crude prices have risen to $90/barrel. Oil company margins may be impacted but pump prices are stable due to recent excise duty changes.

- Concerns remain over gas supplies tied to imports from the Gulf region, which could affect piped cooking gas and CNG costs along with industrial dynamics.

- Inflation moderated to 2.8% in may (a six-year low), though future inflation increases linked to geopolitics remain a concern for policymakers.

- Trade faces war-risk insurance challenges-pricing/availability-and heightened risks for westbound exports amidst escalating tensions in both Hormuz and the Red Sea regions.

- Bab el-Mandeb Strait vulnerabilities due to Israeli airstrikes on Houthi forces could impact nearly 30% of India’s westbound exports; rerouting via Cape of Good Hope may extend delivery times by up to two weeks while increasing costs.

Images:

!Oil, inflation not immediate worries

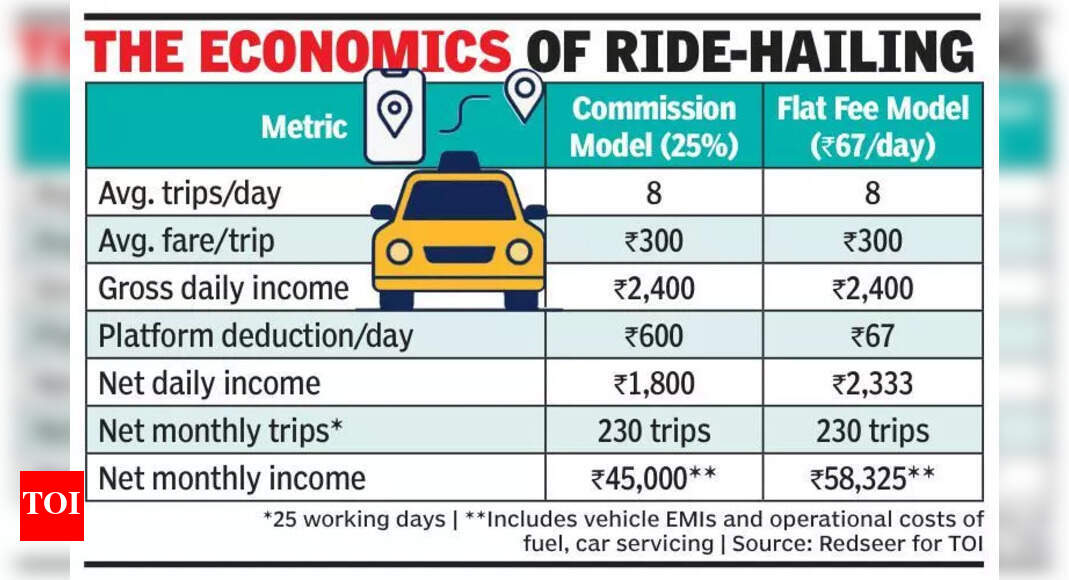

!Oil transport concerns

Indian Opinion Analysis

India’s diversified oil import strategy significantly reduces its vulnerability amid rising geopolitical instability surrounding key global supply routes like the Strait of Hormuz. Increased reliance on Russian crude post-conflict with Ukraine showcases India’s strategic agility in managing disruptions. While Brent’s price rise presents challenges for industry margins, excise duty adjustments have temporarily shielded consumers at fuel pumps.

The broader implications lie beyond just oil markets-gas supply vulnerabilities suggest ripple effects across industrial sectors alongside household energy use. Policymakers must weigh these pressures cautiously against India’s record-low inflation figures while preparing for potential cost escalations driven by extended trade routes or higher war-risk insurance premiums.

Heightened security risk affecting access through both Straits (Hormuz & Bab el-Mandeb) introduces a new layer of complexity that could impose heavy logistical burdens on exporters reliant upon critical westbound trade corridors like Europe/North Africa/U.S., threatening timelines sharply under adverse conditions or secondary routes-a point flagged prudently by Indian trade observers.India’s balanced approach will be key as it navigates these volatile external pressures while safeguarding economic stability domestically amidst persistent uncertainty.