Now Reading: BPCL Q1 Net Profit Soars on Strong Retail Fuel Margins

-

01

BPCL Q1 Net Profit Soars on Strong Retail Fuel Margins

BPCL Q1 Net Profit Soars on Strong Retail Fuel Margins

Rapid Summary:

- Profit Surge: Bharat Petroleum Corporation Ltd (BPCL) reported a record first-quarter net profit of ₹6,839.02 crore for April-June FY26, up from ₹2,841.55 crore in the same period last year.

- Key Factors: The profit increase was driven by holding retail fuel prices despite lower international input oil costs, boosting marketing margins.

- Inventory Losses and challenges: BPCL faced inventory losses due to selling products below input crude oil costs and experienced lower refining margins ($4.88 per barrel vs $7.86 last year).

- Unpaid Subsidy: The company had an unpaid LPG subsidy of ₹2076.2 crore in Q1; the government announced a ₹30,000-crore package to compensate oil retailers.

- Operational Data:

– Turnover remained stable at ₹1.29 lakh crore compared to ₹1.28 lakh crore last year.

– Crude oil processing increased slightly (10.42 million tonnes vs 10.11 million tonnes), as did petroleum product sales (13.58 million tonnes vs 13.16 million tonnes).

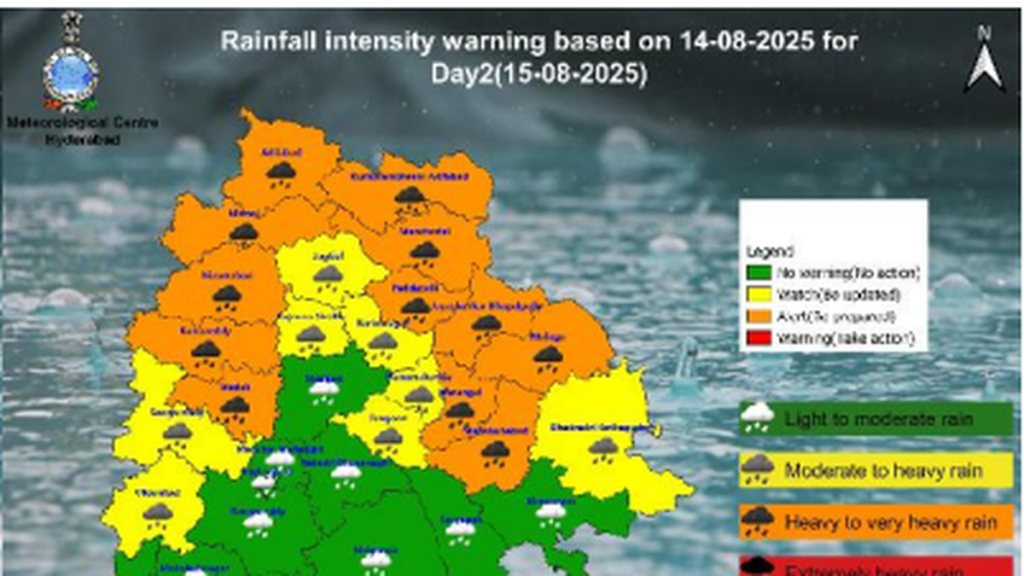

Image Caption: Representational file image | Photo credit: Reuters

Indian Opinion Analysis:

BPCL’s strong first-quarter performance reflects its strategic focus on retail pricing amidst volatile international crude markets while tackling challenges like inventory losses and unpaid subsidies effectively enough to report record profits this quarter. The government’s lag in LPG subsidy reimbursement highlights systemic financial pressures within India’s energy sector that may impact future fiscal stability for state-owned enterprises.

This boost in marketing margins signifies BPCL’s ability to capitalize on market dynamics; however, its reduced refining margin indicates tighter upstream profitability-a potential concern if global benchmarks fluctuate unfavorably further ahead.

On an economic level, higher petroleum sales and consistent throughput reflect steady demand across India’s energy landscape-an important indicator of industrial growth-but unresolved subsidy delays may strain collaboration between government policies and public-sector operations if prolonged into upcoming quarters.