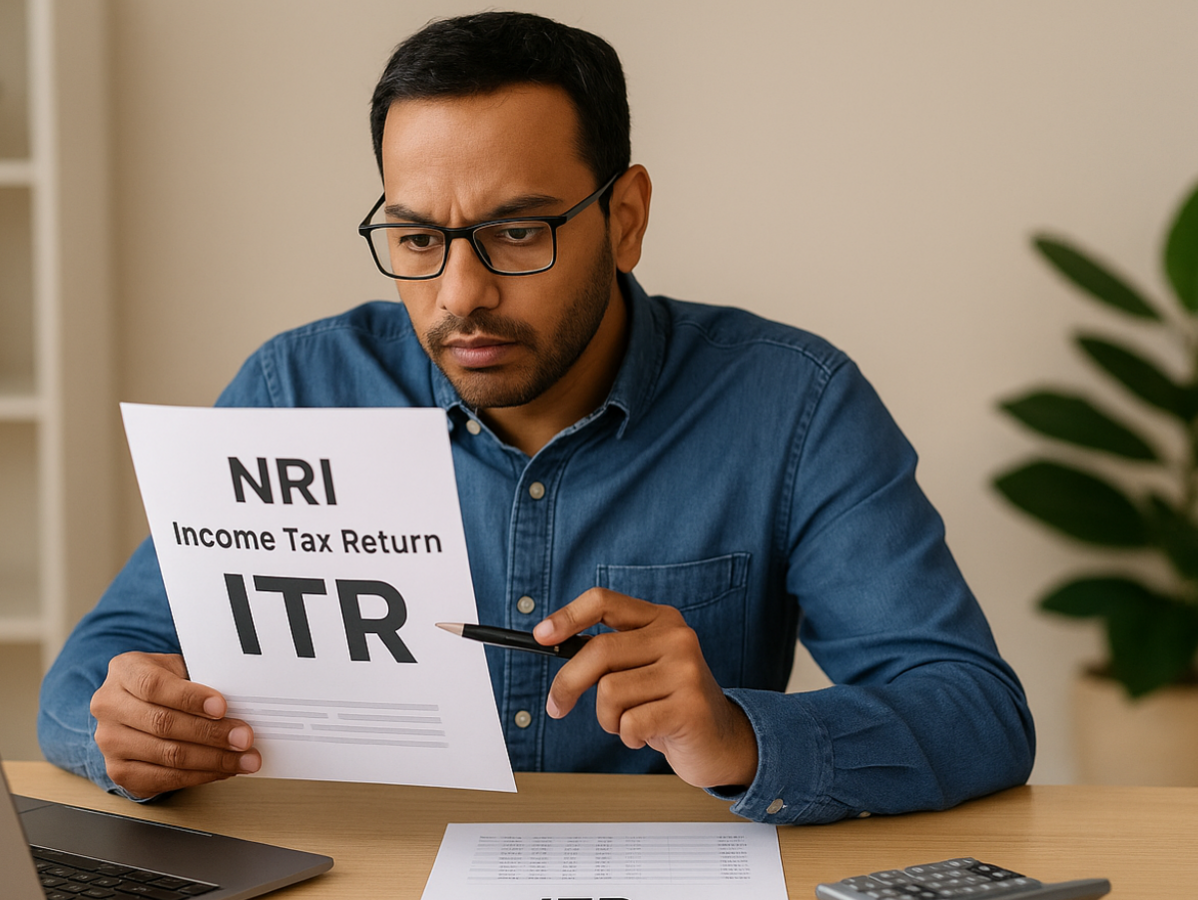

Now Reading: Key Updates NRIs Must Know for Filing ITR in India

-

01

Key Updates NRIs Must Know for Filing ITR in India

Key Updates NRIs Must Know for Filing ITR in India

Swift Summary:

- New ITR Forms Released: India’s Income Tax Department has notified the income tax return (ITR) forms for FY 2024-25 (AY 2025-26). Software utilities for ITR-1 and ITR-4 are now available,while those for ITR-2 and others are awaited.

- Updates Impacting NRIs:

1. Higher Asset Reporting Threshold: NRIs filing ITR-2 must report assets/liabilities only if their gross taxable income exceeds ₹1 crore. Foreign assets/liabilities remain excluded.

2. Capital gains Segregated by Sale Date: capital gains incurred before july 23, 2024, attract old rates; post-july transactions follow the new regime.New segregation in ITR forms simplifies reporting.

3. Enhanced Disclosure Requirements: Utilities like ITR-1 and ITR-4 require detailed reporting of deductions or exemptions claimed (e.g., life insurance policy number for Section 80C).

4. Extended Filing Deadline: The deadline shifted from July to September-now September15,2025-for taxpayers whose accounts don’t require audits.

– Updates to Slabs under new tax but unchanged Old Regime slabs

“Indian Opinion analysis##

-> noted observation’s importantly…