Now Reading: Ride-Hailing Shifts to Flat Fees Amid Falling Commissions

-

01

Ride-Hailing Shifts to Flat Fees Amid Falling Commissions

Ride-Hailing Shifts to Flat Fees Amid Falling Commissions

Quick Summary

- Ola has introduced a nationwide flat fee model for drivers,replacing its earlier commission-based structure.

- Drivers will now retain 100% of their earnings after paying a fixed daily access charge of Rs 67.

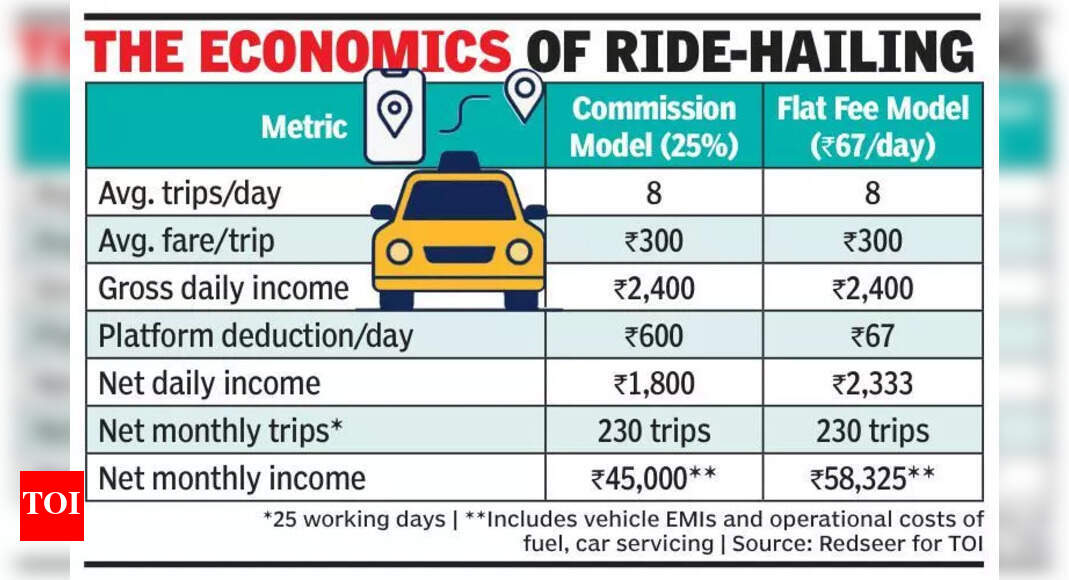

- Previously, platforms deducted 20%-30% per trip under teh commission system; the new structure results in higher net potential income for active drivers (rs 58,325/month vs Rs 45,000/month).

- The move was partly driven by loss of market share and waning supply-demand network effects at Ola. Senior executives acknowledge it as a “desperate hail mary.”

- Ola implemented cost-saving measures like shutting down its acquisition team and reducing incentives to offset margin impacts.

- India’s ride-hailing sector is split into cabs (~50%-55% GMV), auto-rickshaws (~35%), and two-wheelers (~10%-12%). Fares range from Rs 300-400 in top cities vs Rs 200-250 in smaller ones.

- Drivers typically complete around eight trips/day or ~220-240 trips/month. Fare averages translate to gross earnings near Rs 60,000/month for metro drivers.

- Experts suggest flat fees can improve earnings but shift financial risk to drivers; success depends on added driver services like insurance or fuel cards.

Indian Opinion Analysis

Ola’s move toward a flat fee model marks an crucial pivot in india’s ride-hailing industry dynamics by attempting to reconcile operational expenses with improved driver autonomy. While active drivers could benefit via enhanced monthly incomes due to lower platform deductions per trip, this structure increases financial risks for newcomers or those working in low-demand zones-a fact acknowledged by industry experts.

The decision reflects strategic urgency amid declining market share and elevated competition from other players like Uber. However,long-term viability may depend on whether platforms bundle essential ancillary services such as insurance or fuel support alongside fixed pricing to offset risks. Success also hinges on ensuring efficient demand-supply networks across diverse geographical areas within India’s heterogeneous urban landscape.

If successful, this shift could redefine engagement models between gig workers and aggregator platforms locally while inviting broader experimentation globally among competitors navigating similar challenges.!As commissions fall, flat fee reshapes ride-hailing