Now Reading: Smart SIP Strategy to Double Your ₹6.17 Crore Corpus

-

01

Smart SIP Strategy to Double Your ₹6.17 Crore Corpus

Smart SIP Strategy to Double Your ₹6.17 Crore Corpus

Swift Summary:

- Regular SIP investment, even if started early in life, may not suffice for ambitious goals due to lower initial income and inflationary pressures.

- Step-up sips allow investors to incrementally increase their monthly contributions yearly, leading to greater corpus generation over time.

- Example calculation:

– Rs 12,000 monthly SIP at 12% annual return can generate Rs 3.70 crore in 30 years. If stepped up by 8% annually, the corpus grows considerably to Rs 7.61 crore.

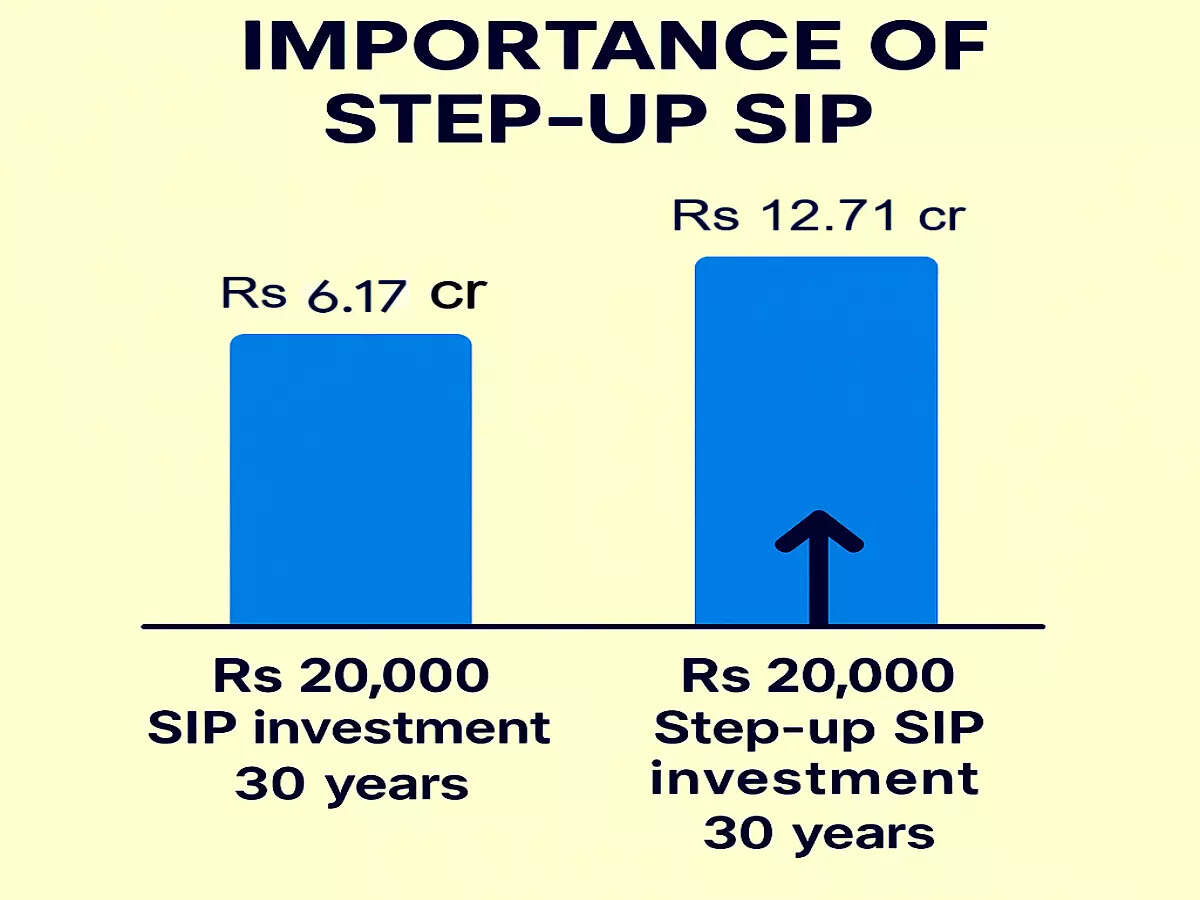

- Another scenario compared regular vs step-up SIP for a Rs 20,000 monthly investment:

– Regular SIP generates Rs 6.17 crore over the same period; step-up results in a corpus of Rs 12.71 crore (an additional Rs.6.54 crore).

- Choosing equities such as large-cap mutual funds with historically higher returns may be essential for inflation-adjusted wealth creation.

Indian Opinion Analysis:

Step-up SIP investments present a compelling strategy for individuals seeking long-term solutions to tackle inflation and ensure financial security post-retirement. By accommodating incremental contribution increases tied to income growth or career advancements, this method aligns saving habits with economic realities.

India’s demographic shift toward younger professionals suggests that many are beginning their retirement planning earlier than before-a positive cultural change with potential widespread benefits.Though, simply aiming for disciplined savings through regular means may expose future retirees to risks like insufficient funds due to rising living costs.

Encouraging informed decisions on stepping up contributions while emphasizing equity-linked investments could strengthen financial independence across multiple economic strata in India without requiring drastic shifts in behavior patterns among savers.

Read More: [Economic Times Article](https://economictimes.indiatimes.com/wealth/invest/regular-sip-vs-step-up-sip