Now Reading: CoinSwitch Founder Criticizes Gen Z’s Vacation Loan Trend

-

01

CoinSwitch Founder Criticizes Gen Z’s Vacation Loan Trend

CoinSwitch Founder Criticizes Gen Z’s Vacation Loan Trend

Quick Summary

- Criticism of Travel Trends: Ashish Singhal, co-founder of CoinSwitch, criticized Gen Z for taking loans to fund vacations. He highlighted that this trend represents a shift from traditional saving habits.

- Data Points on Borrowing:

– Nearly 1 in 4 Indians borrowed money for vacations last year.

– Majority (71%) of vacation loan borrowers are from Tier-2 and tier-3 cities.

– The percentage of Gen Z borrowers has doubled in two years-rising from 14% to 29%.

- Financial Burden Example: A ₹2 lakh loan at an interest rate of 18% results in ₹40,000 additional repayment over a five-year period.This is often paid for short trips focused on social media visibility.

- Cultural Shift Addressed: singhal noted how travel expenses have transformed drastically over generations-moving from basic saving for local trips to high-interest borrowing for international vacations.

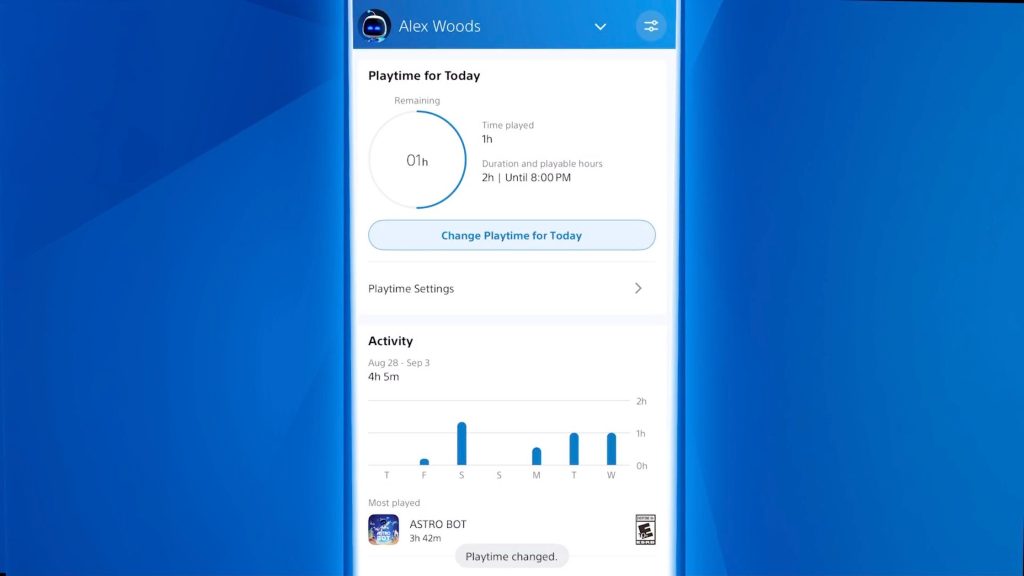

- Proposed Alternatives:

– Create travel funds by saving monthly amounts ahead of the trip.

– Book flights early to avail discounts equivalent to savings on EMIs.

– Use travel credit cards efficiently without incurring interest charges.

Indian Opinion Analysis

The growing preference among young Indians, especially Gen Z, to borrow money for leisure travel reflects a broader cultural and economic shift in the country. This trend highlights changing priorities-from long-term financial planning towards instant gratification fueled by social media expectations.While access to personal credit can positively enable experiences otherwise unattainable, reliance on loan-driven consumption may pose long-term risks as compounding interest adds significant burdens.

For Tier-2 and Tier-3 cities especially, this rise signals evolving aspirations but also introduces potential vulnerabilities. Over-leveraging finances could undermine broader goals like home ownership or business investment-a concern echoed in Singhal’s remarks and users’ comments pointing toward “financial handcuffs.”

India may benefit by encouraging stronger financial literacy programs tailored specifically toward guiding youth on responsible spending habits while balancing lifestyle ambitions with economic prudence.